Caplight is my preferred tool to understand what is happening in the venture capital secondary market

Alex Sharata

Caplight is my preferred tool to understand what is happening in the venture capital secondary market

Alex Sharata

Caplight is my preferred tool to understand what is happening in the venture capital secondary market

Alex Sharata

Backed by

Institutional Trading

The preferred secondary marketplace for the world's leading asset managers and secondary funds

$5B+ of live buy & sell interest on private companies

Instantly connect with vetted counterparties

Access the world’s largest network of institutional brokers

Secondary Market Pricing

Company Database

Investor Database

Institutional Trading

The preferred secondary marketplace for the world's leading asset managers and secondary funds

$5B+ of live buy & sell interest on private companies

Instantly connect with vetted counterparties

Access the world’s largest network of institutional brokers

Secondary Market Pricing

Company Database

Investor Database

Institutional Trading

The preferred secondary marketplace for the world's leading asset managers and secondary funds

$5B+ of live buy & sell interest on private companies

Instantly connect with vetted counterparties

Access the world’s largest network of institutional brokers

Secondary Market Pricing

Company Database

Investor Database

Sourcing

From First Signal to Signed Term Sheet

Track and monitor companies as they move through your deal funnel — from initial discovery to diligence to investment.

Trusted by Global Institutions

Trusted by Global Institutions

Trusted by Global Institutions

Investing Workflows

Built for Traditional VC, Secondary Funds, and Asset Managers

Research, invest, and trade using Caplight’s advanced marketplace, data, and workflow tooling

What people are saying about us

Read about the work we're doing.

Stripe

$94.97B

Klarna

$12.34B

SpaceX

$388.94B

Swiggy

$27.81B

Neuralink

$10.87B

Ramp

$12.75B

Anduril

$33.47B

ByteDance

$266.17B

Canva

$34.45B

Scale AI

$16.05B

Stripe

$94.97B

Klarna

$12.34B

SpaceX

$388.94B

Swiggy

$27.81B

Neuralink

$10.87B

Ramp

$12.75B

Anduril

$33.47B

ByteDance

$266.17B

Canva

$34.45B

Scale AI

$16.05B

Stripe

$94.97B

Klarna

$12.34B

SpaceX

$388.94B

Swiggy

$27.81B

Neuralink

$10.87B

Ramp

$12.75B

Anduril

$33.47B

ByteDance

$266.17B

Canva

$34.45B

Scale AI

$16.05B

Get access to Caplight

Get access to Caplight

Get access to Caplight

Caplight is changing private market investing. The world’s most sophisticated investment managers have already started utilizing our risk management products. Join us and contribute to the evolution of private markets.

Institutional Trading

The preferred secondary marketplace for the world's leading asset managers and secondary funds

$5B+ of live buy & sell interest on private companies

Instantly connect with vetted counterparties

Access the world’s largest network of institutional brokers

Secondary Market Pricing

Realtime pricing on hundreds of late-stage companies. Our MarketPrice™ model is trusted by leading financial institutions and is predictive of where the next secondary transaction will be priced.

Company Database

Comprehensive coverage on every VC-backed companies, seed stage and later

Funding round data on 25,000+ private companies

Growth signals and monitoring tooling

Comprehensive tagging by business model, customer profile, and verticals

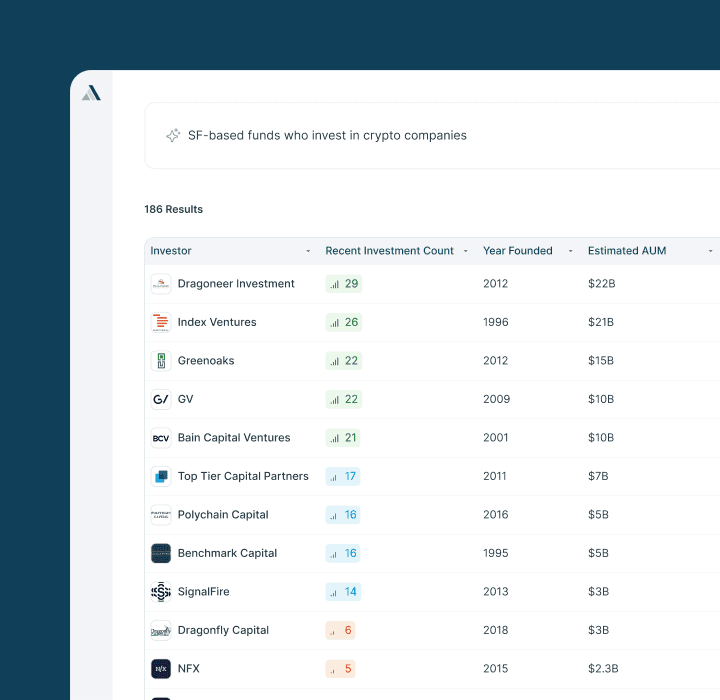

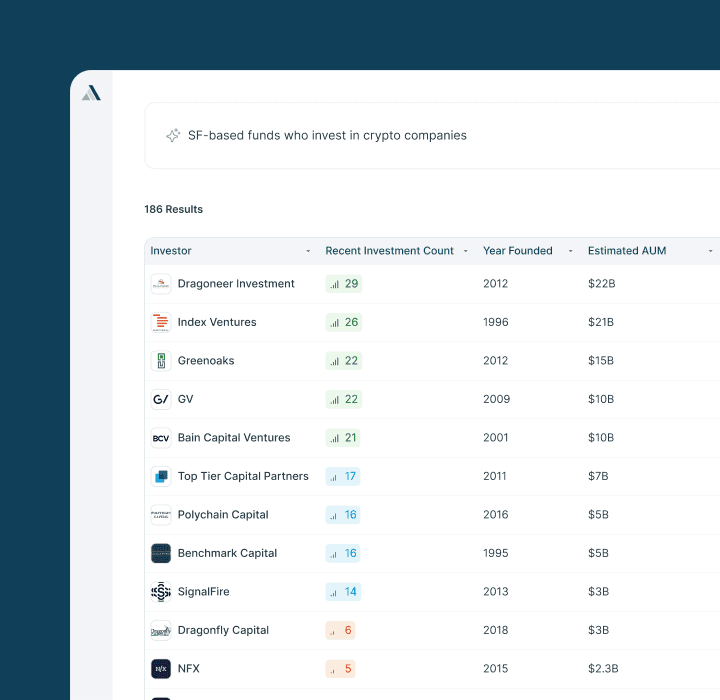

Investor Database

Investor profiles and portfolios for every private market investor

Over 50,000 global investors with stage & sector focus

Key people with contact data

Lead partner data on specific deals

Institutional Trading

The preferred secondary marketplace for the world's leading asset managers and secondary funds

$5B+ of live buy & sell interest on private companies

Instantly connect with vetted counterparties

Access the world’s largest network of institutional brokers

Secondary Market Pricing

Realtime pricing on hundreds of late-stage companies. Our MarketPrice™ model is trusted by leading financial institutions and is predictive of where the next secondary transaction will be priced.

Company Database

Comprehensive coverage on every VC-backed companies, seed stage and later

Funding round data on 25,000+ private companies

Growth signals and monitoring tooling

Comprehensive tagging by business model, customer profile, and verticals

Investor Database

Investor profiles and portfolios for every private market investor

Over 50,000 global investors with stage & sector focus

Key people with contact data

Lead partner data on specific deals

© Copyright Caplight Technologies, Inc. 2025. All rights reserved.

Disclaimer

All investments involve risk, including the risk of loss of principal. You should carefully consider your investment objectives, risks, transaction costs and other expenses before deciding to invest in options, swaps or other investments.

This does not constitute an offer by Caplight Technologies, Inc. to sell, or a solicitation of an offer to buy, any securities and may not be used or relied upon in connection with any offer or sale of securities. An offer or solicitation can be made only through the delivery of final offering document(s) and purchase agreement(s), and will be subject to the terms and conditions and risks delivered in such documents. Any securities offered are offered through Caplight Markets LLC, member FINRA/SIPC.

© Copyright Caplight Technologies, Inc. 2025. All rights reserved.

Disclaimer

All investments involve risk, including the risk of loss of principal. You should carefully consider your investment objectives, risks, transaction costs and other expenses before deciding to invest in options, swaps or other investments.

This does not constitute an offer by Caplight Technologies, Inc. to sell, or a solicitation of an offer to buy, any securities and may not be used or relied upon in connection with any offer or sale of securities. An offer or solicitation can be made only through the delivery of final offering document(s) and purchase agreement(s), and will be subject to the terms and conditions and risks delivered in such documents. Any securities offered are offered through Caplight Markets LLC, member FINRA/SIPC.

© Copyright Caplight Technologies, Inc. 2025. All rights reserved.

Disclaimer

All investments involve risk, including the risk of loss of principal. You should carefully consider your investment objectives, risks, transaction costs and other expenses before deciding to invest in options, swaps or other investments.

This does not constitute an offer by Caplight Technologies, Inc. to sell, or a solicitation of an offer to buy, any securities and may not be used or relied upon in connection with any offer or sale of securities. An offer or solicitation can be made only through the delivery of final offering document(s) and purchase agreement(s), and will be subject to the terms and conditions and risks delivered in such documents. Any securities offered are offered through Caplight Markets LLC, member FINRA/SIPC.